They work in the same fashion as the previous folders. Alert Unusual Options Activity, start following the smart money in real-time Discover patterns by leveraging TradingFlow Data Analytics from real-time or historical data to uncover market partners. The two folders you will use are ‘spread_data’ and ‘spread_output’. Place the same csv files as the daily and weekly reports and place it in a folder titled ‘data_for_validation’.

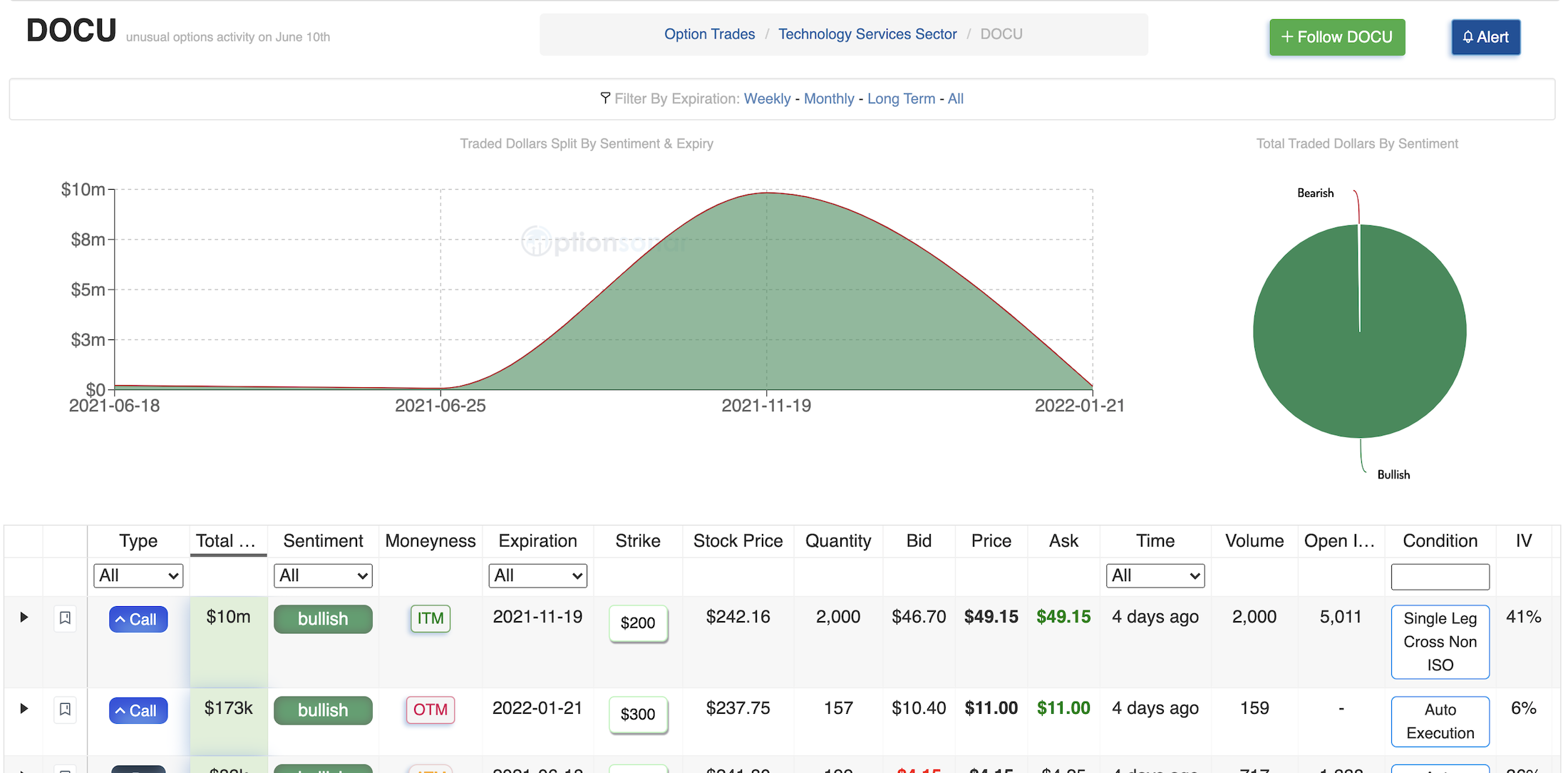

The excel file produced by the script will be titled ‘output’ and found in the ‘output’ folder.įor daily_report.py and weekly_reports.py:ĭownload a csv file from and place it a folder entitled ‘data’ in the working directory. I am no longer working on the credit_spread_daily.py script, but in its current form it can produce daily reports of unusual credit spreads that were opened for that trading day.įor daily_report.py, Performance_Evaluation.py, and weekly_reports.py:Ī folder titled ‘output’ is required in the working directory. The Performance_Evaluation.py script can take raw data from any number of trading days and compute the expected return on those options if they were held to a given expiration day, without any hedging with the opposite option contract. You can generate daily or weekly reports, with their respective scripts. This program analyzes and evaluates the performance of unusual option orders made by investment banks, hedge funds, etc. If there is interest in this type of analysis, I can look into giving it a much needed rewrite/update.

TRACKING UNUSUAL OPTIONS ACTIVITY CODE

I have not looked at the code contained within these scipts since they were created.

Disclaimer: When I wrote all of this code, I was very much a novice with python and more practical coding concepts ( and only gets you so far).

0 kommentar(er)

0 kommentar(er)